Bitwise Files for ETF Targeting Companies with Significant Bitcoin Holdings

Bitwise, a leading issuer of exchange-traded funds (ETFs), has filed a proposal to launch a fund aimed at companies with substantial Bitcoin reserves.

Dubbed the Bitwise Bitcoin Standard Corporations ETF, the fund will focus on publicly traded firms holding at least 1,000 Bitcoin in their corporate treasuries. The move comes amid growing interest in Bitcoin among institutional players adopting the so-called “Bitcoin standard.”

According to the December 26 filing, eligible firms must meet stringent criteria, including a market capitalization of at least $100 million, average daily liquidity exceeding $1 million, and a public free float of less than 10%.

EXPLORE: 3 Experts Predict: How High Can Bitcoin Go In 2025?

Bitwise ETF Prioritizes Bitcoin Holdings Over Market Cap

The ETF stands out by weighting investments based on the market value of a company’s Bitcoin holdings rather than its overall market cap, capped at a maximum of 25%.

For example, MicroStrategy, which holds 444,262 BTC, would have greater weight in the ETF than Tesla, despite Tesla’s significantly larger market cap, as it holds a comparatively modest 9,720 BTC.

The filing coincides with Bitcoin’s recent performance surge, having crossed six figures for the first time in November before stabilizing around $95,800.

Bitwise files for Bitcoin Standard Corporations ETF…

Would own stocks of companies that have adopted the “bitcoin standard”, which they define as holding at least 1,000 btc in corporate treasury.

The btc treasury operations virus is spreading. pic.twitter.com/me0XXX9a6g

— Nate Geraci (@NateGeraci) December 26, 2024

Companies like MicroStrategy have become synonymous with corporate Bitcoin adoption, while newcomers such as KULR Technology Group have joined the trend, recently acquiring 217.18 BTC for $21 million. This purchase led to a 40% jump in KULR’s stock price.

On the same day, Strive Asset Management, founded by Vivek Ramaswamy, filed for regulatory approval to launch an exchange-traded fund (ETF) focused on “Bitcoin Bonds.”

These bonds, as detailed in the December 26 filing, include convertible securities issued by companies like MicroStrategy or others intending to allocate proceeds predominantly to Bitcoin purchases.

The Strive Bitcoin Bond ETF will be actively managed, offering direct exposure to these bonds or through financial derivatives such as swaps and options. However, details regarding the management fee have not yet been disclosed.

MicroStrategy, a key player in this trend, has spent roughly $27 billion on Bitcoin since 2020 as part of a corporate treasury strategy initiated by co-founder Michael Saylor.

This aggressive Bitcoin acquisition strategy has propelled MicroStrategy’s stock, MSTR, to an extraordinary 2,200% gain, outpacing nearly all major public companies except Nvidia.

Other corporations have also embraced Bitcoin for their treasuries, with total corporate holdings now estimated at $56 billion, according to BitcoinTreasuries.net.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

U.S. Bitcoin ETFs See $475M Inflows After Four-Day Outflow Streak

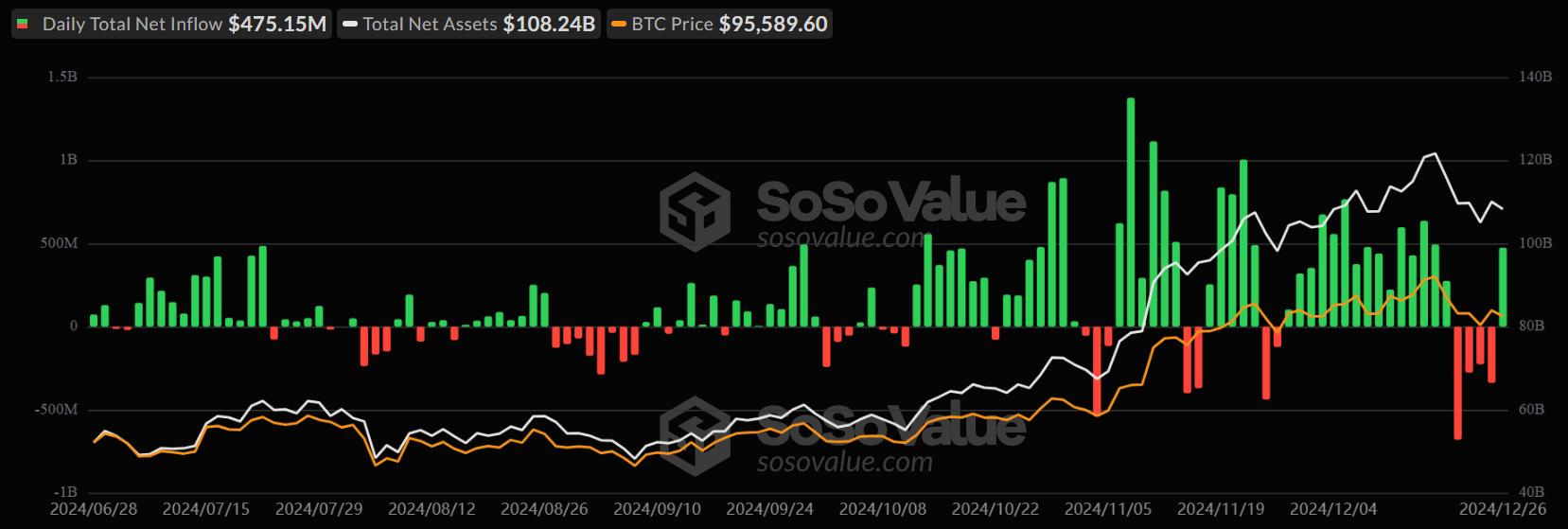

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded a significant inflow of $475.15 million on Dec. 26, breaking a four-day outflow streak that saw over $1.5 billion leave these funds.

(Source)

Data from SoSoValue shows that Fidelity’s FBTC led the inflows with $254.37 million, followed by ARK 21Shares’ ARKB, which attracted $186.94 million.

BlackRock’s IBIT contributed $56.51 million, while smaller inflows from Grayscale Bitcoin Mini Trust and VanEck’s HODL added to the positive momentum.

However, these gains were slightly offset by outflows from Grayscale’s GBTC and Bitwise’s BITB, which saw $24.23 million and $8.32 million in withdrawals, respectively.

EXPLORE: Could These 3 Altcoins Change Your Life in 2025?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Bitwise Files for ETF Targeting Companies with Significant Bitcoin Holdings appeared first on 99Bitcoins.